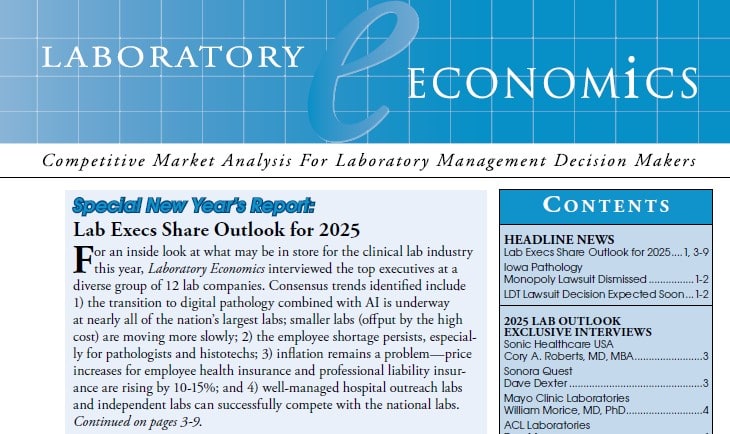

Lab Execs Share Outlook for 2025

Alverno Laboratories

Alverno Laboratories (Hammond, IN) fully implemented digital pathology seven years ago and scans between 1.2 million and 1.5 million slides per year. The lab is now looking to replace its early technology with more up-to-date scanners, according to Chief Executive Sam Terese. Currently, Alverno provides services to about 100 pathologists.

Alverno is also working with Ibex Medical Analytics (Brookline, MA) to use AI to improve testing for prostate, breast, and gastric cancers. In addition, Alverno is exploring other uses for digital-AI—such as in cytology, microbiology, and hematology.

Alverno, a joint venture between Franciscan Alliance and Ascension Illinois, operates over 30 hospital laboratories and provides testing to more than 2,500 physician offices, freestanding urgent care facilities, and research organizations. The lab currently employs almost 2,000 people and performs 15–16 million billable tests each year.

In 2024, Alverno experienced staff vacancies between 20% and 30%, but a newly implemented program called N.O.W. (Need a Career? Opportunity Awaits With Alverno!) has reduced the vacancy rate to less than 10%. The program offers a variety of opportunities across multiple degree levels that can provide an accelerated path to a new lab career.

Retention remains a challenge, particularly for phlebotomists in the competitive Chicago area. “We offer phlebotomy training and have affiliations with multiple programs,” notes Terese. “Phlebotomists aren’t hard to find; they’re hard to keep.” In terms of inflation, the biggest price increases have been seen in insurance—especially cyberinsurance—which has increased about 20%, according to Terese.

Sonic Healthcare USA

Sonic Healthcare USA (Austin, TX) is in the process of digitizing its dermatopathology division. “It’s our highest priority and will help us deal with the pathologist shortage,” says Chief Executive Officer cory A. roberts, MD, MBA. Sonic gained an integrated digital pathology solution (image management+AI+LIS) for dermatopathology through its acquisition of Pathology Watch (Murray, UT) in January 2024. Pathology Watch has the system in place at its three dermpath labs, and Sonic is installing scanners and implementing the system at its 10 dermpath practices, notes Roberts.

Sonic employs a total of 7,500 people in the United States, including over 380 pathologists – of which 70 are dermatopathologists. The company also has plans to digitize its prostate biopsy cases and add AI tools developed by Franklin.ai, a joint venture with Harrison.ai (Sydney, Australia).

Over the past year, Sonic has integrated the management and sales teams of its clinical lab and anatomic pathology services across the country into four geographic regions (West/Southwest, Midsouth, Northeast and Pacific/Hawaii). This new structure has lowered costs and allowed Sonic to sell its clinical/AP test services to hospital and physician office clients as a unified package, according to Roberts.

New test introductions at Sonic include ThyroSeq (licensed from UPMC), a next-gen sequencing test used to determine whether a thyroid nodule is malignant or benign. The test is performed at a new 21,000-square-foot NGS lab in Rye Brook, NY.

Sonora Quest Laboratories

Sonora Quest Laboratories (Phoenix) grew its operating margin by more than 15% in 2024 by increasing revenue (approximately $450 million per year). Growth was driven by an increase in the number of tests per requisition and a shift toward more specialized tests, notes President and CEO Dave Dexter.

Sonora Quest, which has 3,900 employees, performs more than 100 million tests per year—primarily at its labs in Phoenix, Tucson, and Yuma. The lab is a subsidiary of Laboratory Sciences of Arizona and a joint venture between Banner Health and Quest Diagnostics.

Dexter highlights that one area of growth is the development of physician-owned laboratories (POLs). Sonora Quest now has more phlebotomists in physician offices than in its standalone patient service centers. In addition, Sonora Quest has developed a “hybrid” lab with VillageMD, which focuses on value-based primary care. The lab is housed within Sonora Quest’s 250,000-square-foot core lab yet operates as a separate entity managed and staffed by VillageMD.

“Other POLs that we have built and manage for other corporate customers are stand-alone operations, some of which we staff and some that we don’t,” says Dexter. The company has several additional POLs planned, focusing on kidney care, oncology, and other specialties.

Sonora Quest is also moving toward full digital pathology—now operational at three hospital sites where more than 1,000 slides are scanned daily. To date, Sonora Quest has surpassed 500,000 total slides scanned and expects to reach approximately 1.5 million scans annually once the transition is complete.

Two additional components of Sonora Quest’s digital transformation include moving all software applications to the cloud and partnering with Cedar, a healthcare billing company, to implement digital billing that has improved collections.

Like many labs, Sonora Quest has taken steps to recruit and retain staff. In 2024, the lab made a significant “equity adjustment,” increasing base pay for approximately 1,100 phlebotomists. In 2025, similar adjustments are planned for medical laboratory scientists and technicians. Dexter believes managing the workforce will be one of his biggest challenges in 2025. “The expectations of Gen Z are completely different from those of Gen X or Baby Boomers. What matters most to them is flexible scheduling and quick feedback,” he says. “In 2025, we will focus on equipping leaders with effective skill sets to manage multi-generational teams.”

Mayo Clinic Laboratories

Mayo Clinic (Rochester, MN) continues to progress in its transition to digital pathology, according to President and CEO William Morice, MD, PhD of Mayo Clinic Laboratories. More than 50% of its surgical pathology cases—including 100% of dermatology cases—at the Mayo Clinic Rochester campus are now being digitized and interpreted by pathologists via computer monitor.

Mayo Clinic employs over 180 staff pathologists and PhD laboratory scientists. The clinic uses Leica/Aperio GT450 scanners with the Sectra digital pathology system and processes roughly two million slides per year from its internal practice as well as from outside clients.

In addition, Morice notes that Mayo recently completed digitizing its archive of 12 million glass slides using Pramana scanners. Mayo is working with outside vendors while also developing AI applications internally for anatomic pathology. Initially, the AI will manage digitized cases and direct them to the appropriate subspecialist, and it is also being developed for clinical diagnostics—including breast and prostate cancer cases.

Mayo Clinic Laboratories, which performed approximately 26 million tests in 2024, typically adds 80–100 new tests to its menu every year. Historically, most new tests were developed internally. Recent additions include a urine assay (SORD testing) that screens for peripheral neuropathy and a metagenomics assay capable of identifying more than 1,000 pathogenic organisms in cerebrospinal fluid.

Mayo has also begun partnering with outside diagnostic test developers. For example, it has partnered with Progentec Diagnostics for a blood test to manage systemic lupus erythematosus and added Alzheimer’s tests developed by C2N Diagnostics to its menu—complementing its own Alzheimer’s test (p-Tau217).

ACL Laboratories

ACL Laboratories (West Allis, WI) increased its test volume by approximately 10% to more than 60 million tests last year, according to President Dan Mumm. Growth was fastest (up 14%) in the southeast (NC, SC, GA & AL), particularly in the Charlotte area; growth in the Midwest (IL & WI) was in the 3–5% range.

ACL Labs is an independent lab company owned by Advocate Health (Charlotte, NC), which includes 69 hospitals in the Midwest and southeast. Mumm says ACL Labs is finalizing vendor selection for whole-slide-imaging scanners that will be installed at core histology labs in Milwaukee, Chicago, Charlotte, and at Atrium Health Wake Forest Baptist (Winston-Salem, NC) by year’s end. An RFP for image management software is set to go out soon. The goal is to have ACL’s 205 affiliated pathologists transition to digital pathology within the next three years. Using enterprise-wide slide scanners and image management software will eventually simplify the application of AI for case management, referrals, consults, and clinical diagnostic tools, notes Mumm.

ACL Labs is also consolidating its instrument and reagent contracts and is installing an enterprise-wide blood culture solution using bioMérieux’s Virtuos. The lab plans to consolidate its reference testing lab contracts—currently held by ARUP Labs (Midwest) and Labcorp (southeast)—within the next two years. In the meantime, ACL Labs will open a new lab for whole genome/exome sequencing at its Rosemont core lab (just outside Chicago) this spring. ACL Labs has also recently insourced pharmacogenomic testing for cancer drugs (e.g., DPYD genotyping) as well as noninvasive prenatal testing (NIPT).

Longer term, Mumm says ACL Labs is considering ways to provide lab testing to rural and urban patients who lack easy access to doctor’s offices or patient service centers. Possible solutions include collecting specimens in anticipation of future lab orders after patients have traveled long distances for care. Additionally, Advocate Health is providing mobile health clinics and is considering adding lab, pharmacy, and radiology services in the future.

ARUP Laboratories

ARUP Laboratories (Salt Lake City, UT), which employs nearly 4,750 people, continues to consolidate its instrument platforms to gain efficiencies and offset inflationary pressures, according to Chief Executive Andy Theurer. For example, all mass spectrometers have been consolidated into a single lab from which all diverse tests using this methodology are performed.

ARUP is a national reference lab enterprise of the University of Utah’s Department of Pathology, which employs 110 pathologists. Theurer anticipates that the University of Utah Division of Medical Laboratory Sciences’ new Advanced Practice Clinical Laboratory Training Center will open this May. The center will double the number of new medical technologists trained each year from 40 to 80, and ARUP hopes to hire nearly all of them.

ARUP first installed a new digital pathology and AI system for ova and parasite testing in 2019. Developed in partnership with Techcyte, the system has doubled the productivity of ARUP’s microbiology technologists. In addition, Theurer notes that the University of Utah’s Department of Pathology is planning to install new digital pathology scanners within the next 12–18 months so that additional pathologists outside of Utah can perform digital interpretations.

ARUP offers a test menu of more than 3,200 tests and typically adds 50–100 new tests each year. Recent additions include a bird flu (H5N1) test, a rapid acute myeloid leukemia targeted therapy mutation panel, and an Alzheimer’s disease biomarker test on cerebral spinal fluid—with a second AD biomarker test (for blood) planned for this spring.

Finally, Theurer says ARUP has developed a blood management data visualization software tool that uses historical data to estimate how many units of blood transfusion patients might need based on their preoperative characteristics. The tool helps physicians prevent adverse events (such as volume overload or hemolytic reactions) and minimizes unnecessary waste of valuable blood products, saving money for both the lab and the health system. ARUP plans to offer this software tool to clients this year.

Orion Laboratories

Orion Laboratories (Baton Rouge, LA) processed approximately 600,000 lab claims (2.4 million tests) in 2024 and is already on track to double that amount in 2025, according to CEO David Slaughter. Orion was started in 2016 in a garage office by David and his wife, Rachael (who serves as President).

Initially focused on providing phlebotomy and specimen pickup services, Orion opened a 3,000-square-foot laboratory in 2019 and then moved into a larger 32,000-square-foot facility in early 2024. Orion currently employs 75 full-time equivalents, offers a clinical lab test menu of 515 tests, and provides services to 240 hospitals, nursing homes, and physician office sites throughout Louisiana. In addition, Orion has a subsidiary—Orion Therapeutics—that serves as a third-party sample tester for the state’s medical marijuana program.

Slaughter notes that Orion has only one sales representative (Rachael) and that growth is fueled primarily by word-of-mouth from existing clients. The lab benefits from its quick turnaround times and the fact that there are no major hospital outreach labs in the Baton Rouge area. (For context, Franciscan Missionaries of Our Lady Health System sold its outreach lab business to Labcorp in 2020.) Orion’s challenges include gaining in-network status with national health plans (e.g., Aetna and Cigna) and managing rising costs for employee health and professional liability insurance.

Orion added 45 tests to its menu last year (all FDA-cleared test kits), including ABO Grouping and Rho(D) Typing, post-vasectomy semen analysis, mycoplasma genitalium PCR, and Herpes Simplex 1/2 (HSV) PCR. Slaughter says Orion is holding off on adding new laboratory-developed tests because of new FDA regulations.

Advanced Pathology Associates (APA)

Advanced Pathology Associates (Rockville, MD) currently has three pathologists using digital pathology to sign out their cases. Three additional pathologists will convert to digital by March 30, with the final three scheduled to convert by September 30, according to Nicolas Cacciabeve, MD, Managing Member.

Slide scanning is performed at a freestanding central histology lab—Capital Choice Pathology Lab (Silver Spring, MD), owned by Adventist HealthCare. APA provides medical and administrative directorship for the central histology lab, which houses four scanners (two Philips Ultrafast Intellisite and two Roche 600 scanners) and processes 29,000 cases and 160,000 slides annually.

Cacciabeve asserts that digital pathology improves pathologist productivity by 10–12% through better organization, improved assignment of cases, and more ergonomically friendly interpretations. However, he believes the greatest productivity gains (30–50% improvement) will come from applying AI to digitized images. AI applications will be developed and implemented quickly—driven by emerging studies showing that AI-assisted diagnoses are both more accurate (with improved sensitivity) and more precise (with better inter-observer and intra-observer reproducibility). Over time, digital pathology combined with AI-assisted interpretations is expected to become the standard of care.

Challenges remain, however. Cacciabeve points to the ongoing shortage of pathologists and rising salary demands; APA currently has two open pathologist positions. “Pathologists coming out of fellowships are asking for salaries that someone with 5–10 years of experience would expect… This has been one of the most pronounced disruptions in salary structure that I have seen in over 30 years as both a practicing pathologist and an employer.”

APA employs 20 people, including nine pathologists and four pathologists’ assistants. The group provides medical director and lab management services to three Adventist HealthCare hospitals and its central histology lab, plus two hospitals in the University of Maryland Healthcare System. Cacciabeve also indicates that APA will soon hire a dermatopathologist to serve local dermatology practices.

Wisconsin Diagnostic Laboratories (WDL)

Wisconsin Diagnostic Laboratories (Milwaukee), which performs more than 8.5 million tests per year, recently opened a new molecular genomics laboratory in partnership with the Medical College of Wisconsin’s Department of Pathology, according to President Steve Serota. Initially, the new lab will offer 15 molecular tests, with plans to increase to 45 tests by the end of the first quarter.

WDL is owned by Froedtert Health System and employs 550 people. It serves 57 hospitals, 750 long-term care facilities, and 380 physician practices—primarily in Wisconsin and northern Illinois. Following the merger of Froedtert with ThedaCare Health in early 2024, lab leadership has been centralized though physical locations remain unchanged.

In late 2023, WDL launched Atalan, a tech-enabled platform that connects physicians and hospitals with clinical laboratories nationwide. “Atalan is a tech-enabled clinical partnership platform that allows academic and affiliated laboratories to partner together to use each other’s reservoirs of capacity and collaborate on innovation,” explains Serota. “The idea is to lower the commercial barriers to market entry for hospital- and affiliated laboratories so they can offer their tests to partners in noncontiguous geographies.”

Test ordering and results are connected digitally via a centralized hub that supports LIS-to-LIS integrations, thereby reducing demands on IT teams. For example, if a lab has only one subspecialist pathologist and that person is unavailable, the lab can send the case to another partner in the network—a reciprocal relationship that benefits all parties, especially patients.

Currently, Atalan includes three partners (Froedtert Health in Wisconsin, South County Health in Rhode Island, and TriCore Reference Laboratories in New Mexico), with plans to add six to eight more partners by the end of 2025. “We see Atalan as a way for WDL both to expand our outreach and to partner in the development and validation of new assays, while also spurring cooperation and innovation within the laboratory industry as a whole,” says Serota.

WDL expects to add 125 tests to its menu this year. At present, WDL offers about 2,700 tests, including more than 500 laboratory-developed tests. Serota is hopeful that compromises on FDA regulation of LDTs will be reached. Due in part to the recent Froedtert–ThedaCare merger, WDL anticipates growth of 10–15% in 2025, with test revenues exceeding $12 million. The lab is also expanding its local outreach business, with a particular focus on federally qualified health centers.

Associated Pathology Medical Group (APMG)

Joe Song, Chief Executive of Associated Pathology Medical Group (APMG, Los Gatos, CA), explains that his group is helping to cover the education expenses for its lab assistants to become histotechnologists. There is a notable shortage of histotechs in California, and recruiting staff from outside the state is challenging—especially given the high cost of living in the San Francisco Bay Area (small homes sell for over $1 million on average, and one-bedroom apartments rent for around $3,000 per month).

To offset inflationary pressures, Song says APMG is working to secure longer-term contracts (5–6 years) with instrument and reagent vendors. APMG has also successfully negotiated higher reimbursement rates from health insurers for certain anatomic pathology test codes. New test additions for 2025 at APMG include one-swab testing for women’s health panels (for example, bacterial vaginosis, chlamydia/gonorrhea, and trichomonas). With 84 employees (including nine pathologists) and four hospital contracts, along with a full-service histology lab, APMG is one of the largest independent pathology groups in northern California.

Joint Venture Hospital Laboratories (JVHL)

Joint Venture Hospital Laboratories (JVHL, Allen Park, MI) is a hospital outreach laboratory network serving health plans throughout Michigan as well as northern Ohio and Indiana. The network has grown to include more than 120 hospital members serving 5.6 million covered lives under 28 regional and national health plan agreements. JVHL network members perform more than 20 million tests per year under these agreements, according to Chief Executive John Kolozsvary.

Kolozsvary says JVHL has a tremendous opportunity to leverage strategic partnerships and data analytics to advance population health and chronic disease initiatives. For example, JVHL recently completed a data mining project with the National Kidney Foundation to examine kidney disease trends and is exploring additional opportunities to provide analytics to health plans. JVHL is also working to expand its footprint in utilization management and is actively pursuing accreditation from the National Commission on Quality Assurance.

He notes that hospital laboratories in Michigan face the same staffing challenges as labs nationwide, responding with wage adjustments and recruitment incentives. To support recruitment efforts, JVHL has hired a laboratory professionals recruitment coordinator. These initiatives have included workforce education sessions with hospital HR and lab leaders, training program directors, and participation in high school career fairs.

Kolozsvary is aware that commercial labs are approaching hospital and health system members with various business proposals—including the sale of their outreach labs. “Selling a hospital laboratory program might solve some short-term financial needs, but much more must be considered as part of the evaluation process,” he says. “This includes the lab’s organizational structure, potential alternate business and reimbursement models, the impact on test turnaround times, patient satisfaction, the value of the longitudinal medical record, and referring physician loyalty.” JVHL also keeps a close eye on leakage of lab testing to commercial laboratories due to concerns over fragmented care and increased out-of-network costs for patients.

JVHL is owned by four health systems: Corewell East (Beaumont Health), McLaren Health Care, Michigan Medicine (University of Michigan), and Trinity.

Medical University of South Carolina (MUSC) Health

Staffing shortages—especially for histotechnologists—remain one of the biggest challenges in the lab industry, according to Tony Bull, former System Administrative Officer for Pathology and Laboratory Medicine at MUSC (Charleston, SC). MUSC Health includes 11 hospitals and 18 labs, employing 720 lab staff. Staffing shortages are intensifying as test volumes grow. MUSC Health processed 9.1 million tests in the year ended June 30, 2024, and is expected to reach 10.1 million tests in the current fiscal year, Bull reports.

To address understaffing, MUSC has turned to new technology and automation in areas such as microbiology and histology. Bull notes that three Philips UFS300 scanners have been in use at its flagship hospital in Charleston since 2020, and that gastroenterology cases have transitioned to digital pathology. MUSC is working to expand digital pathology into additional subspecialties (renal, cardiovascular, some placentas) across the system.

MUSC Health also insourced roughly two million tests per year from its owned physician clinics in 2021—tests that were previously processed by an out-of-state commercial lab—resulting in turnaround time improvements of one to two days on average. While vendors have been pushing for price increases on supplies, reagents, and analyzers as contracts come up for renewal, MUSC has leveraged its size to keep prices flat or slightly lower.

Recently, MUSC expanded its DNA testing capabilities by adding a Genomadix Cube rapid analyzer for CYP2C19 testing (to identify patients unable to metabolize the blood-thinner Plavix) and by adding CYP3A5 testing for determining tacrolimus doses for transplant patients.

Note: Tony Bull resigned from his position at MUSC effective December 31, 2024.